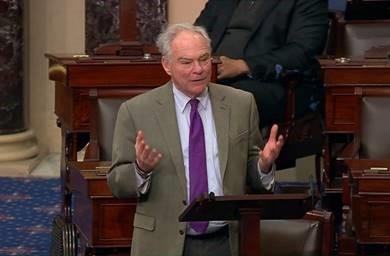

Video: Kaine Speaks on Senate Floor to Oppose Republican Proposal to Cut Taxes for Billionaires and Raise Costs for American Families

BROADCAST-QUALITY VIDEO IS AVAILABLE HERE.

WASHINGTON, D.C. – Today, U.S. Senator Tim Kaine (D-VA) spoke on the Senate floor in opposition to President-elect Trump and Republicans’ proposals to cut taxes for billionaires and impose broad-based universal tariffs, which would raise costs for American families. Trump and Republicans in Congress are currently negotiating an extension to Trump’s 2017 tax law, which cut taxes for large corporations and the highest-income earners and substantially increased the federal deficit.

The Congressional Budget Office (CBO) has estimated that extending the law without any changes will add $4.6 trillion to the national debt over the next decade. Other tax experts’ estimates have shown that Trump’s tariffs could raise costs by $2,500 to nearly $4,000 per household and American consumers could lose between $46 billion to $78 billion in spending power each year.

“Taxes should be fair, they should be consistent, they should be predictable, and they should generate the revenue that America needs to fund Social Security, Medicare, education, roads, national security, and the other critical investments that matter to our constituents,” said Kaine.

But, Kaine said of the 2017 tax law, which he opposed, “Our Republican colleagues plummeted and slashed the corporate tax rate not to 28%, not to 25%, but to 21%—and didn’t even pay for it… just racked up higher deficits… The bill also left out our nation’s poorest children. Nearly 20 million children were left out of the full value of the child tax credit because it was not made refundable.”

“On top of these inequities that the bill was too heavily weighted toward corporations, too light toward individuals—and with individuals, too heavily weighted toward the wealthy rather than lower- and middle-income people—the Republican bill in 2017 did another thing that was entirely, entirely unjustified. The bill made the corporate tax cuts permanent and the individual tax cuts temporary,” Kaine continued. “And that brings us to today: Republicans debating how to ram another $4.6 trillion in tax cuts through the Senate.”

Kaine then spoke about how Trump’s tariff plans would further hurt working class Americans, saying: “If President Trump moves forward with broad-based, universal tariffs—and they’re not defeated in this body—American families will suffer. American families will pay the cost. We know it because we’ve seen it before. Study after study showed that American consumers bore the brunt of Trump’s first trade war, and this time it will be even more.”

“I urge my colleagues … don’t go down that path again. Work with us to find a tax bill that will appropriately prioritize the needs of everyday American citizens and small businesses,” Kaine concluded.

###